Univar + Brenntag back of the envelope

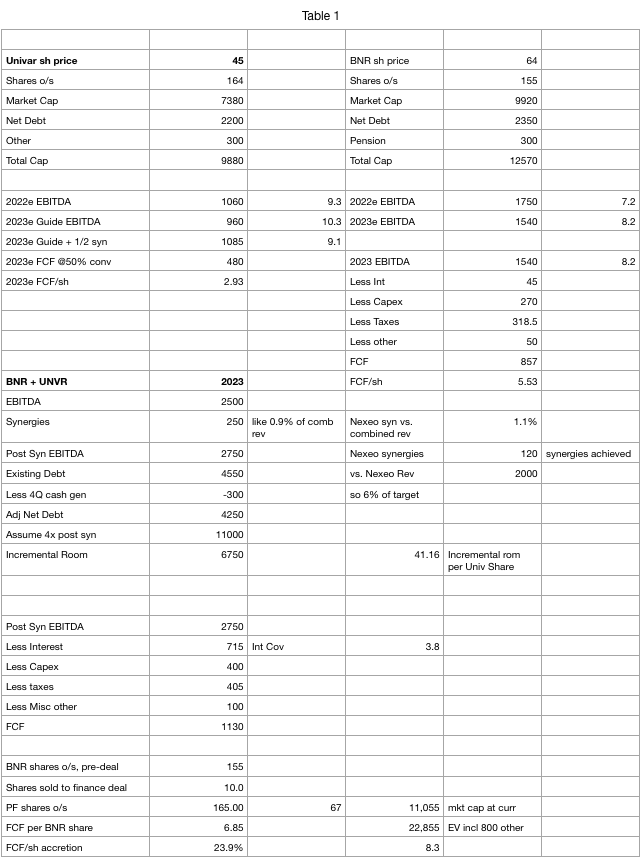

Late last week it was reported that the global leader in chemical distribution Brenntag (BNR.GR) is considering an acquisition of the number two player Univar (UNVR). While I think BNR could pay $45 per share, fund the deal almost entirely in debt, and have the transaction be nicely accretive, I think a proposed deal will run into antitrust issues in the US as the combined entity would have 25%+ market share and trigger a close look from DOJ.

Both companies benefitted from chemical inflation/strong demand in 2022 and are overearning (UNVR's 2023 EBITDA guide assumes a 9.5% YoY EBITDA decline; I assume BNR's EBITDA to decline 12% given greater European exposure).

As you can see, assuming BNR were willing to lever up to 4x ND/EBITDA (pf), I believe Brenntag could pay $45/sh for Univar and still have a nicely accretive (+23% EPS uplift) while accomplishing its objective of increasing its share of profit coming from the US.

However, I see challenges for such a transaction. As best I can tell a deal would put the combined market share greater than 25% in the US which would trigger a throrough antitrust review.

Disclaimer: this is just like my opinion man. Do your own work.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.