Shopping Center REITs

Broadly speaking, I believe there have been several meaningful positive changes which have occurred over the past several years in the shopping center REIT space which are currently under appreciated by investors.

Positive changes include:

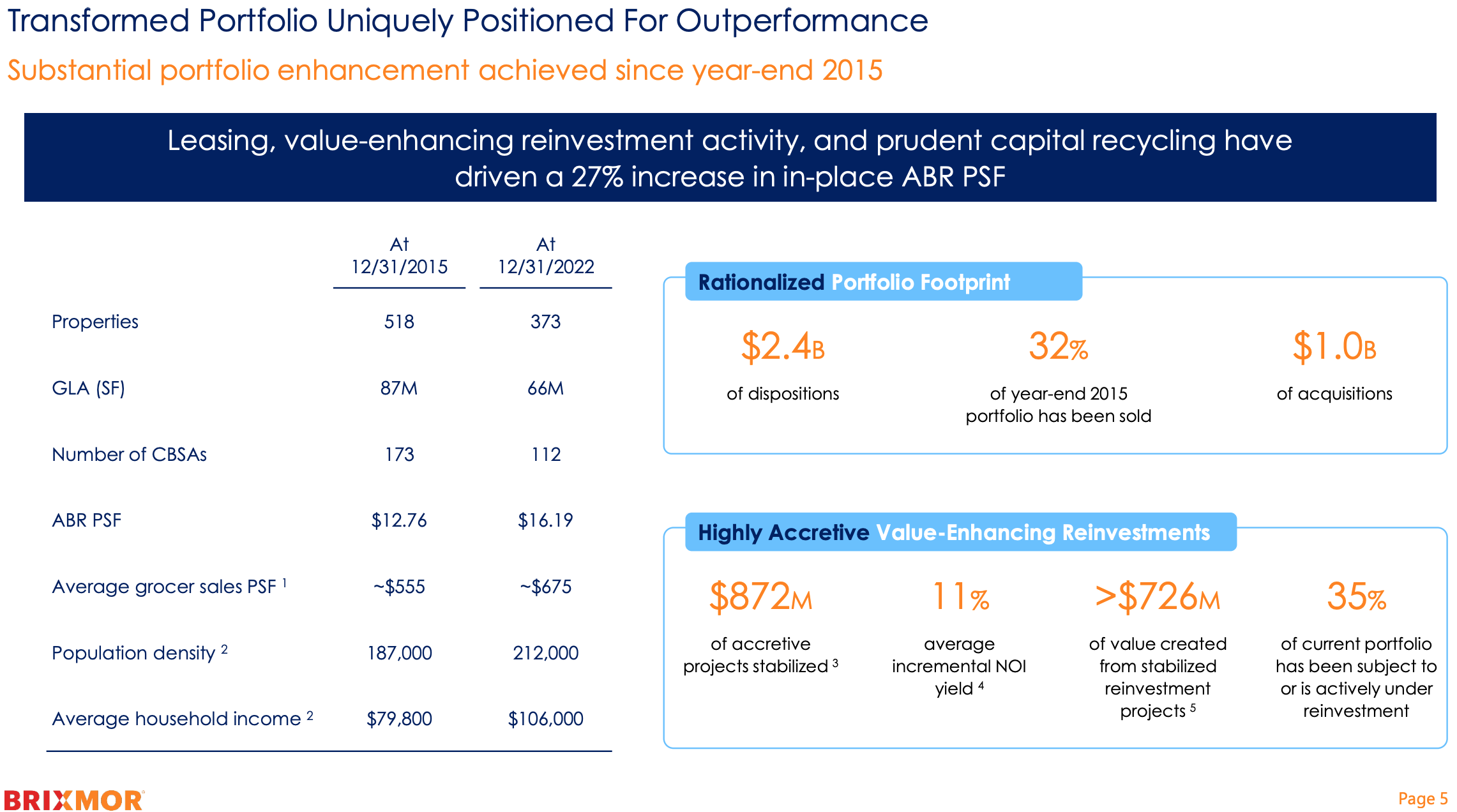

-Portfolio rationalization (moving up the average household income/density curve) - Below I show the transformation which has taken place at Brixmor (BRX) over the past 8 years). Similar transformations have taken place at Site Centers (SITC), Kite Realty (KRG), RPT Realty (RPT), and others.

This transformation was executed in a value accretive manner whereby less desirable centers (lower density/household income/lack of local scale) were divested. Importantly most of these divestitures occurred at cap rates below the implied cap rate at which BRX shares traded (i.e. at the time of sale the private market was valuing the bottom quartile of the company's assets at a higher valuation than public markets were valuing its better/best assets). Having divested lower quality properties, today's income stream/NOI is is worthy of a lower cap rate (higher valuation) than that of 7 years ago.

-Improved Balance Sheets - Proceeds from asset sales have been used to deleverage balance sheets. Lower debt balances coupled with strong NOI growth have reduced sector leverage ratios from 7x ND/EBITDA to sub 6x. The timing here is prescient as interest rates have increased.

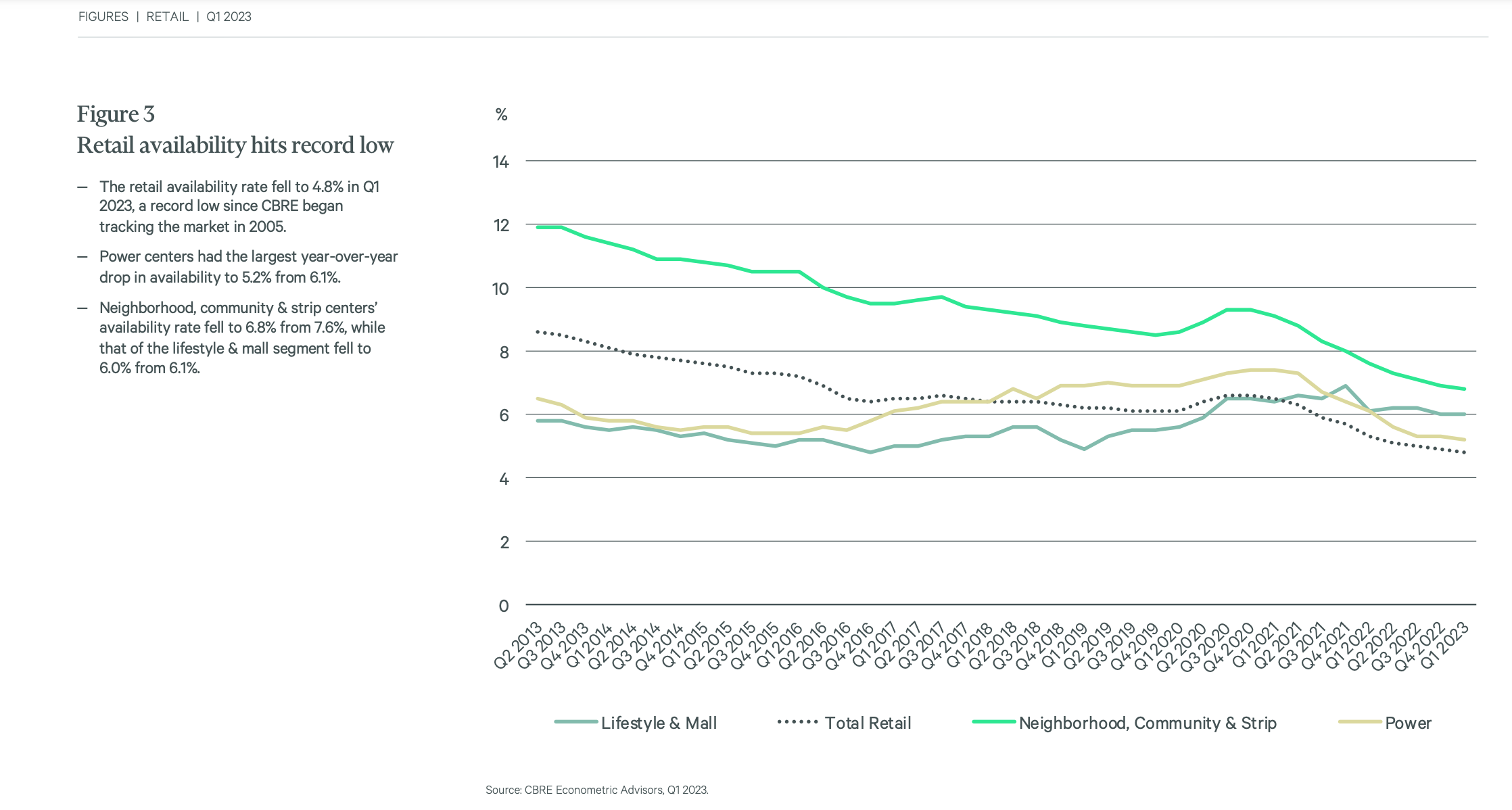

-Era of mass store closures is behind us (see right side of 'Record Low Supply Chart' below)

-Absence of New Supply over past decade - as shown on the left side below, there has been little new retail development over the past decade. Historically high store closures/retail apocalypse narrative deterred the development of new shopping centers throughout the 2010s-present period.

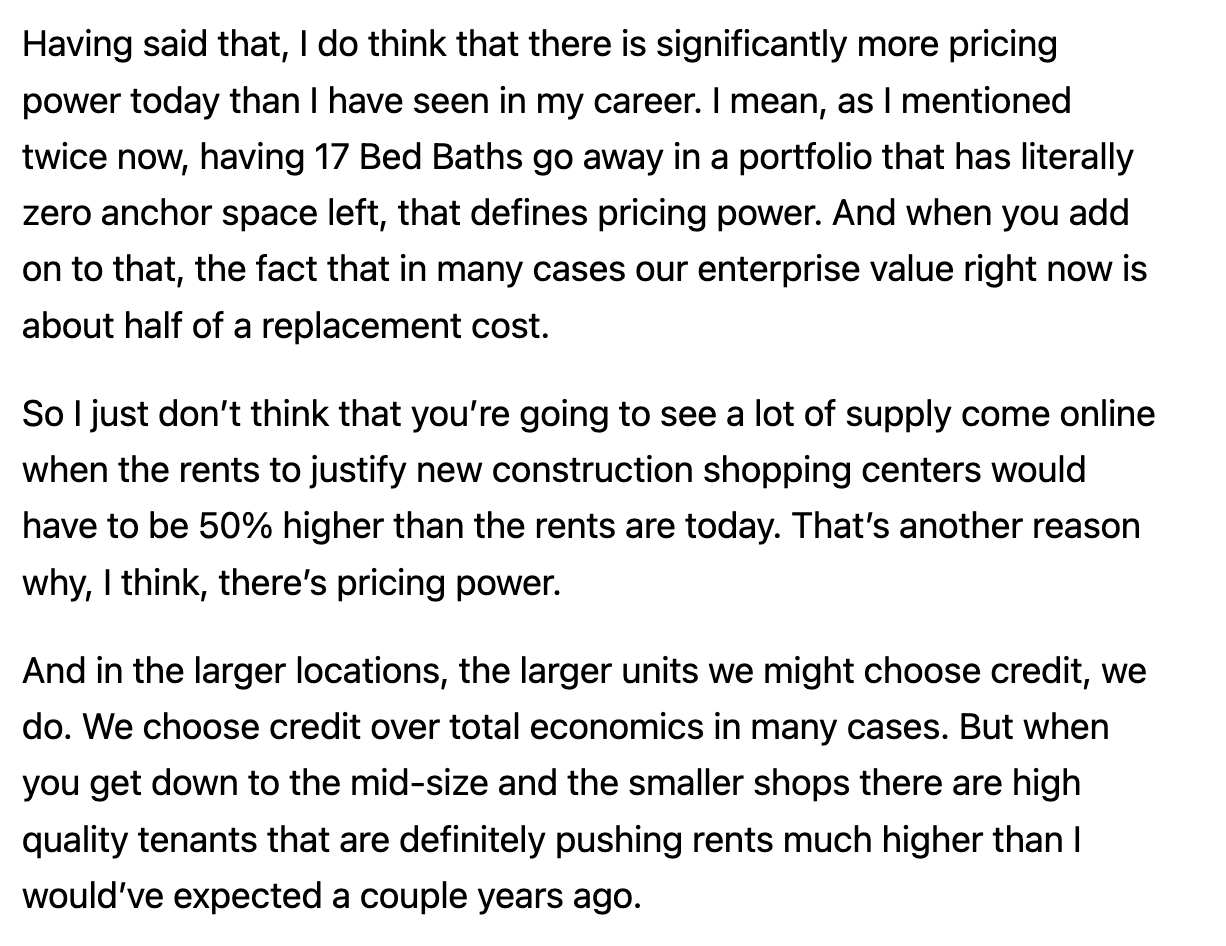

-Difficulty of Bringing New Supply to Market - the period of high inflation has significantly increased construction costs. Coupled sharply higher interest rates and withdrawal of lending by the regional banking sector (regional banks are the leading providers of RE development financing) has further limited the likelihood of meaningful new shopping center supply. The cost to bring new supply to market is significantly above the implied per square foot value of shopping centers:

-Platform Value /Ability for Value Add - shopping center REITs have scaled platforms of leasing teams with relationships with national/regional tenants supported by data and analytics. This is a competitive advantage versus smaller operators who don't have the scale to invest in both systems but also actively redevelop shopping centers to improve their relevance to the community. The shopping center REITs have focused on creditworthy traffic generators including grocers, leading off-price retailers (TJX/ROST/BURL), and specialty retailers (ULTA/FIVE).

-WFH Creates More Shopping Opportunities/ Move to the Burbs - the post-pandemic shift toward work from home has likely created a permanent increase in traffic to suburban shopping centers. With most workers now spending only 2-4 days per week in the office, the demand for suburban consumer products and services has shifted upward. Retailers, restaurants, gyms and other service providers are opening locations at a faster pace to meet this additional demand.

-Leasing Demand is as strong as it has been in 8-9 years -the absence of new supply coupled with increased demand has culminated in higher leased shopping center space/limited vacancy. This allows leading shopping centers to be choosy when selecting tenants (higher value tenants->higher shopping center value) and supports medium term rent growth.

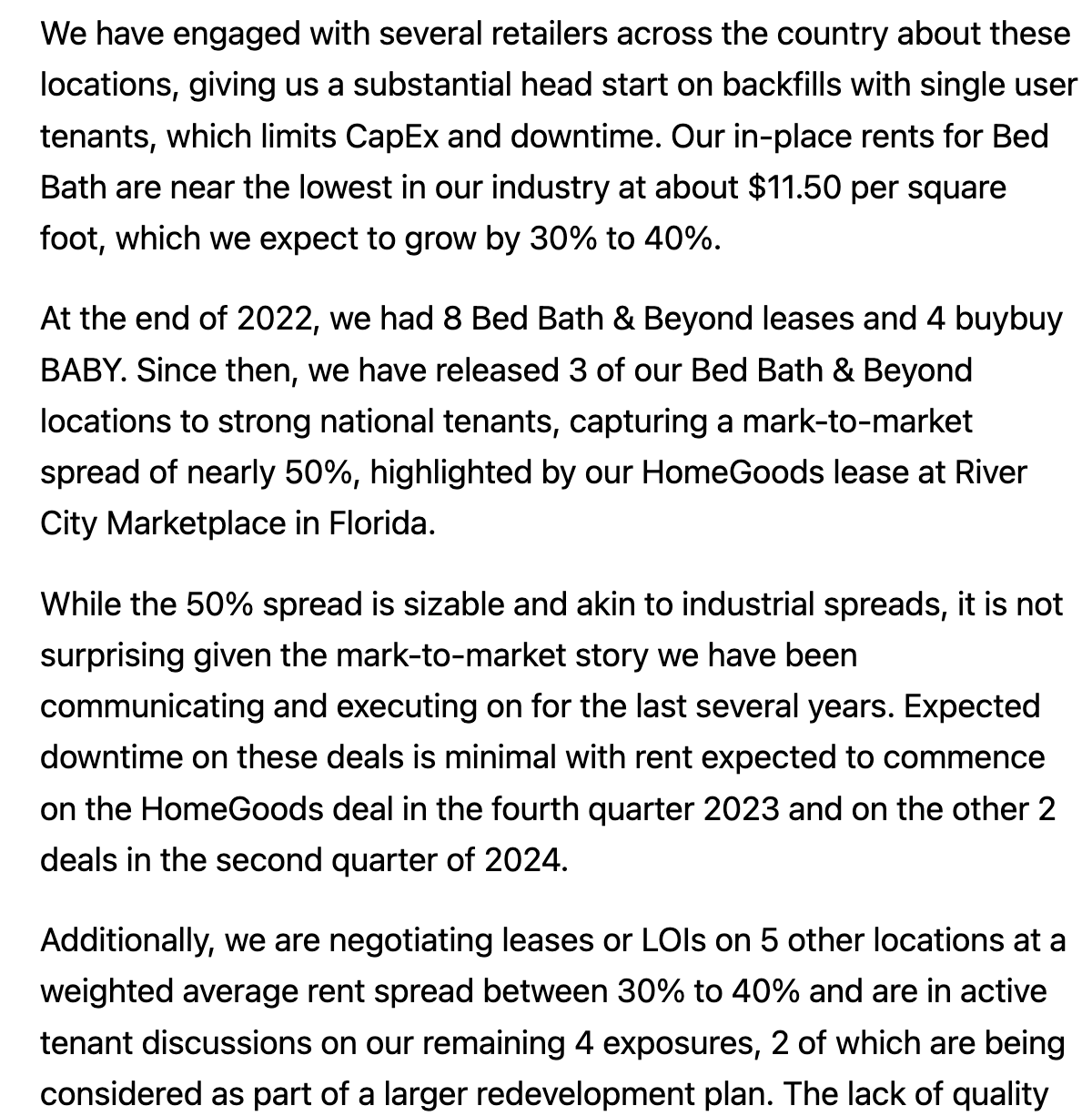

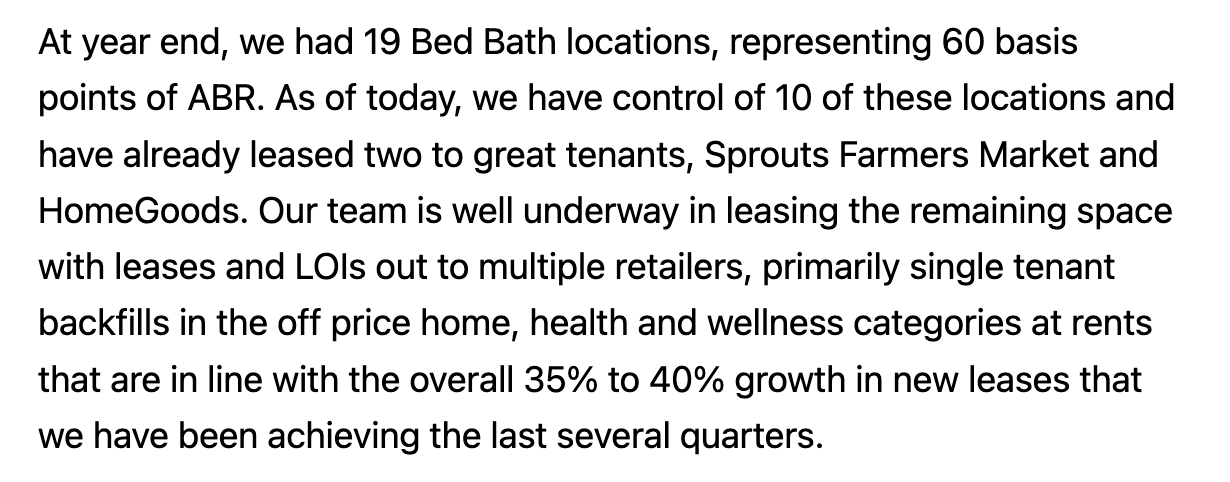

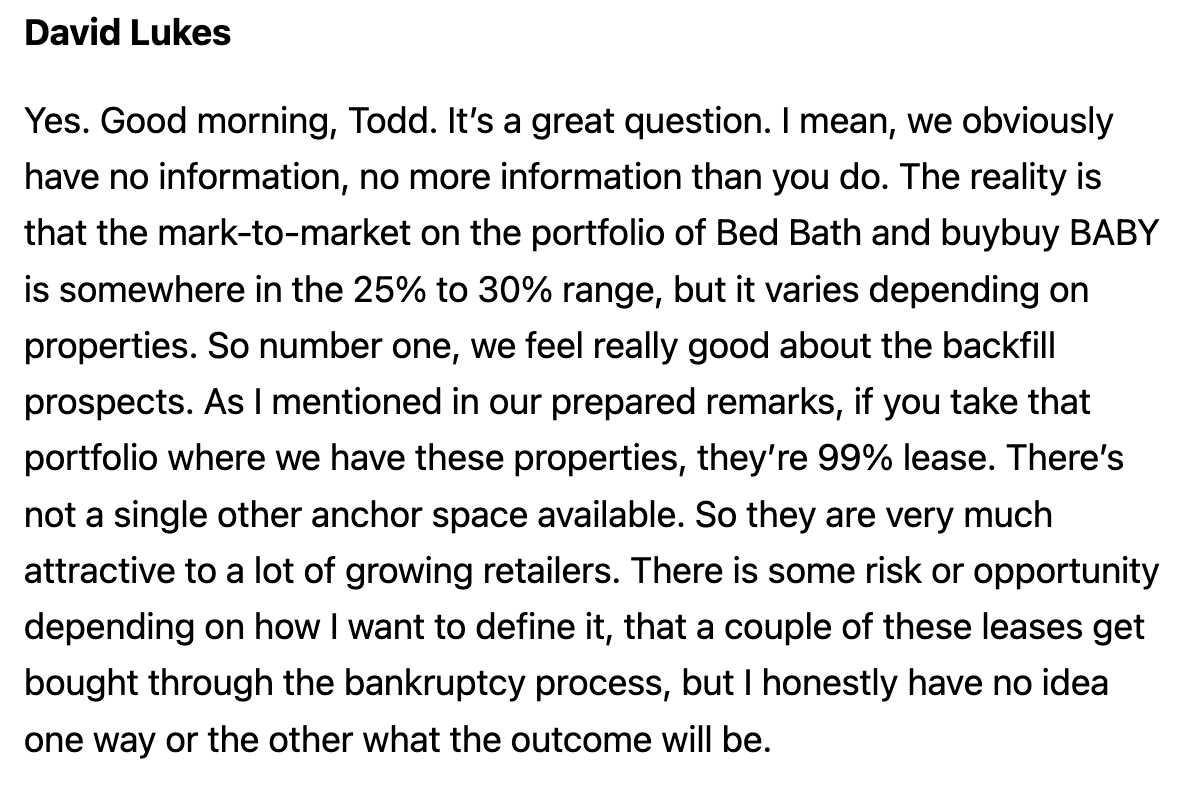

The competition for available space following the demise of Bed Bath and Beyond illustrates the shifting dynamics of the supply/demand balance for leading shopping centers.

Not only will shopping centers benefit from higher rents than those paid by Bed Bath & Beyond but traffic to the center will increase as new, stronger tenants draw more consumers. Replacing a dead retailer with relevant tenants with stronger credits increases both the NOI but also the multiple (lower cap rate) for the center.

-Opportunities for Density - shopping centers tend to have excess parking capacity which can be re-developed into new uses (apartments/hotels) or converted to pad sites (think Starbucks or Chipotle drivethru which can be retained or sold at low NNN cap rates).

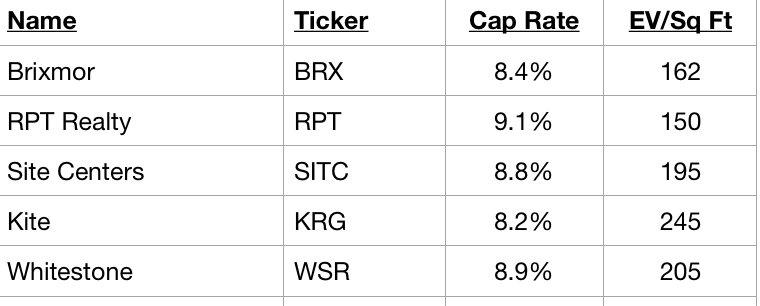

-Valuation - many shopping centers trade at attractive valuations as the positive attributes described above has failed to garner a rerating from investors. While Regency (REG), Kimco (KIM), Federal (FRT) trade inside of a 7 cap (Regency just acquired Urstadt Biddle (UBP) at a 7.2 cap/310 per ft), shopping centers REITs including Site Centers (SITC), Brixmor (BRX), RPT (RPT) and Whitestone (WSR), all of whom have undergone positive portfolio transformations over the past 6-7 years trade at discounted valuations:

These positive changes discussed above are masked by:

- REITs have been decimated over the past 18 months as interest rates have soared (and the financing market for private deals has stumbled).

2. Retail Tumult: After reporting bumper results in 2021 on the back of stimulus spending, many retailers have seen significant declines in profitability and share prices. Declining health of its customer base has naturally lead to concerns about a potential increase in retailer bankruptcies /reduced store opening appetite going forward. These concerns have been exacerbated by broader economic worries.

The counterpoint here is that 1/ the gap between leased (vs physical) occupancy is at/near multiyear highs (reflective of large pipeline of leases signed where the tenant has not yet occupied the location -there tends to be a 12-24 month lag between the signing of a lease and physical occupancy) 2/ growing interest amongst leading retailers in maintaining/growing suburban shopping center footprint as a result of pandemic related shifts in shopping habits 3/ robust multiyear growth plans of healthy retailers/restaurants like TJX Companies, Ross Stores, Burlington, Five Below, Ulta, Chipotle, Starbucks, Sprouts, Aldi, Bath & Body Works, Academy Sports, Grocery Outlet, Publix, Floor and Decor, Bootbarn, Dutch Bros, Planet Fitness, BJ's, Shake Shack, Total Wine, Dave & Busters, Dollar General (including Popshelf), Bob's Furniture, among others.

Song

Disclaimer: I'm long BRX, SITC, RPT, KRG and WSR. I could be totally wrong. Do your own work.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.