2Q25 Resi REIT thoughts + Cap Rates / Per Door / 4yr IRR

The voting machine turned decidedly sour on the resi REITs following reporting season. Here is my take:

What the market didn't like:

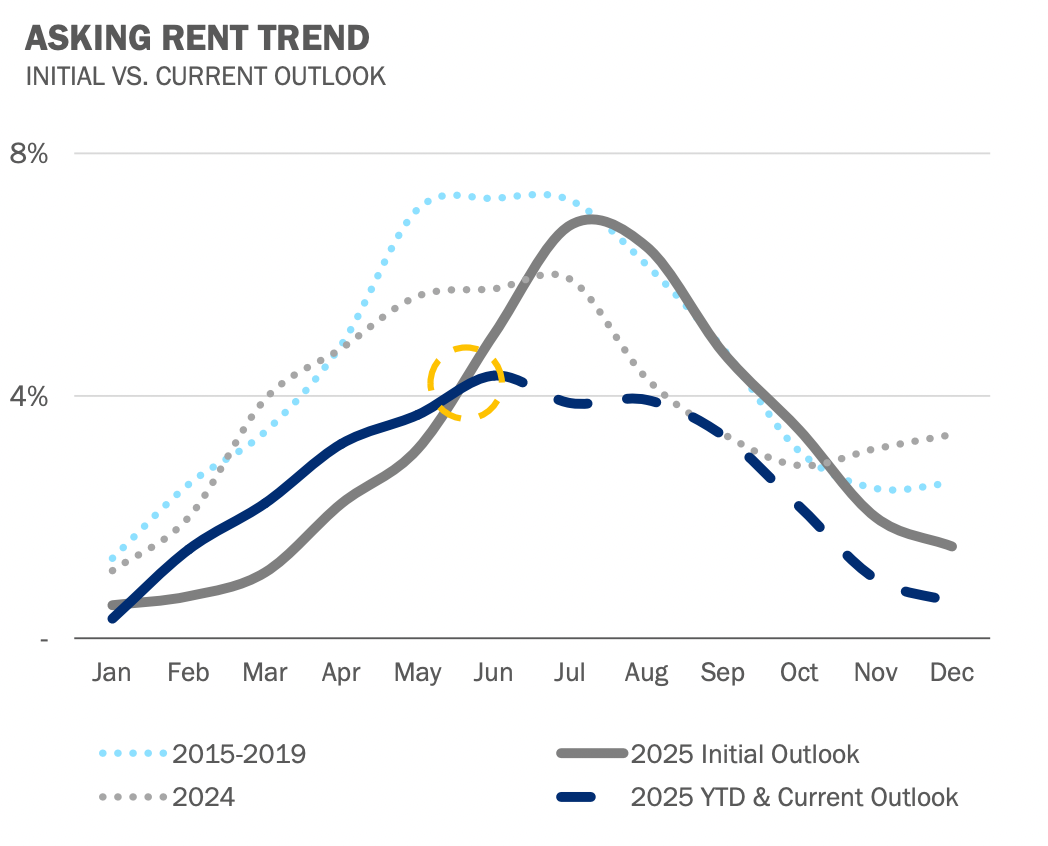

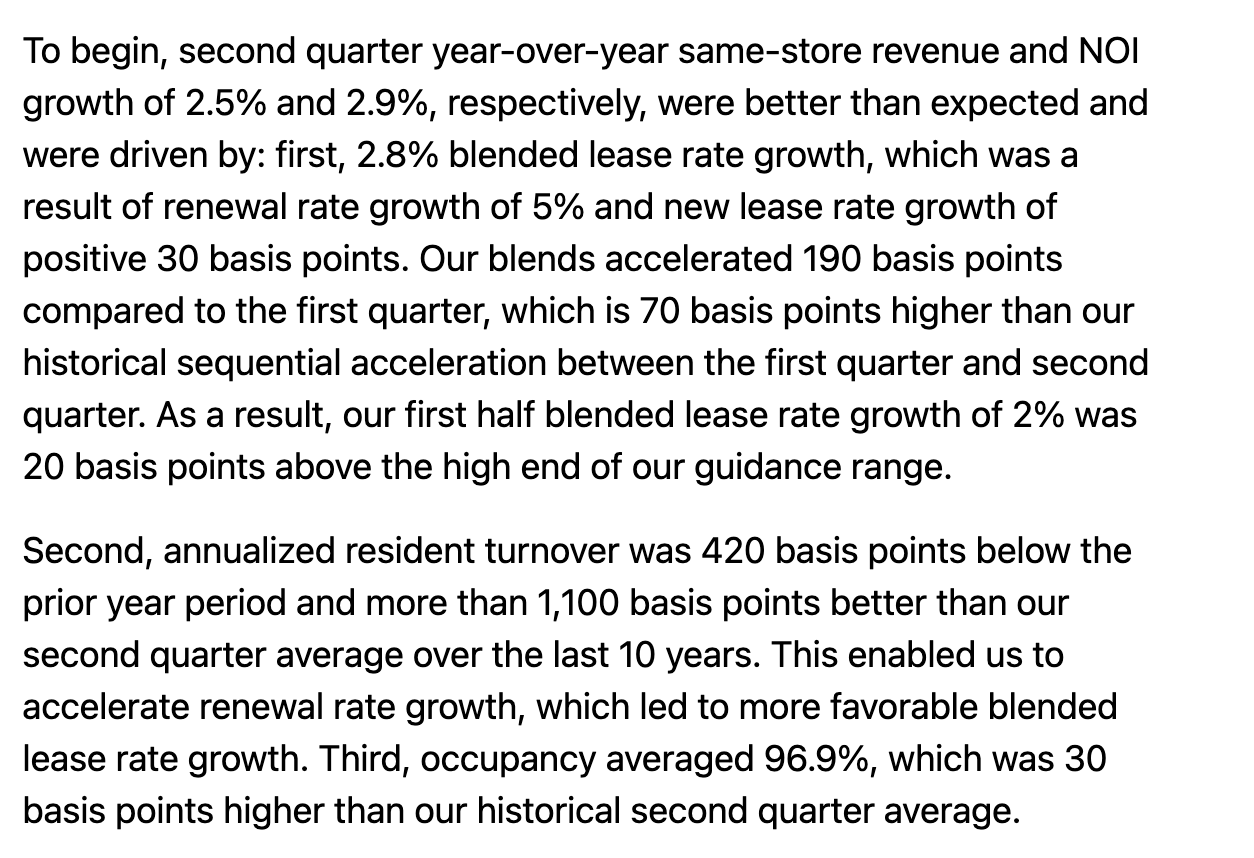

-As shown below, after starting the year strong, rent rebound/new lease rates have stalled:

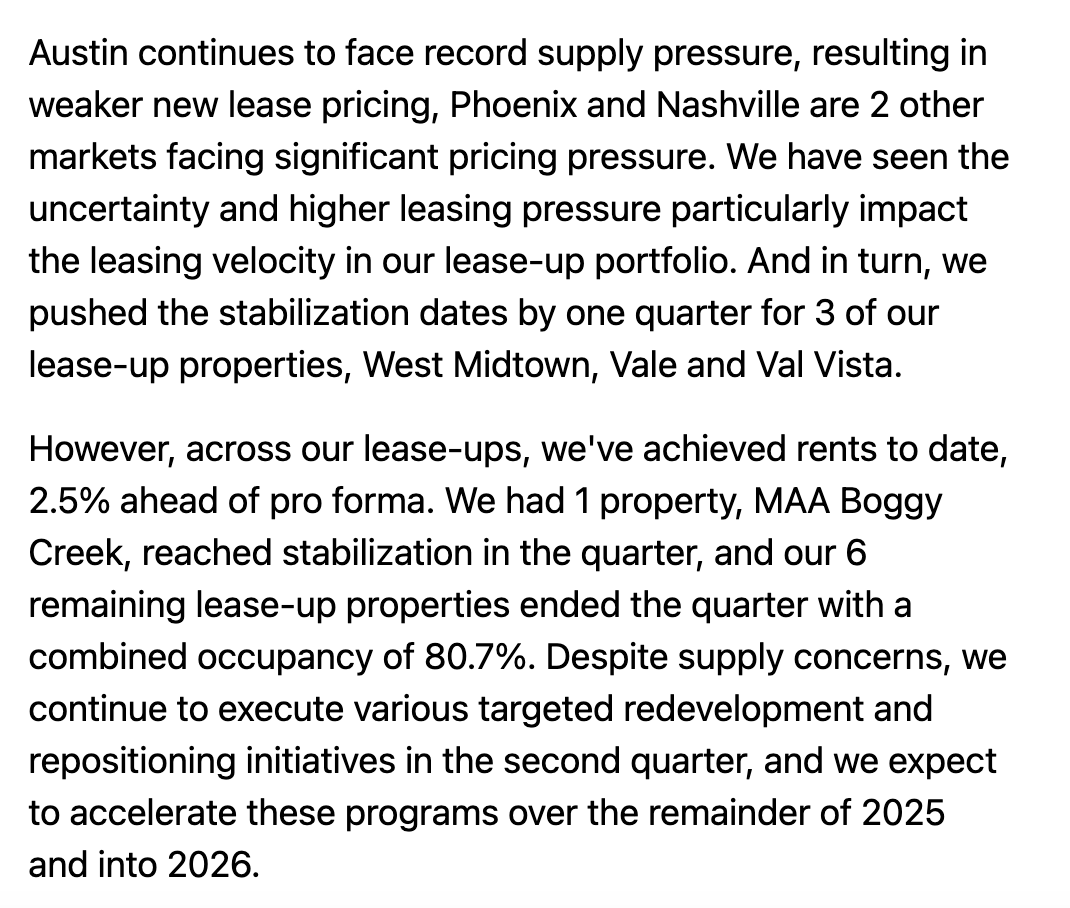

-Stabilization of new developments has been pushed out a teensy/tinsy bit

The pretty ok:

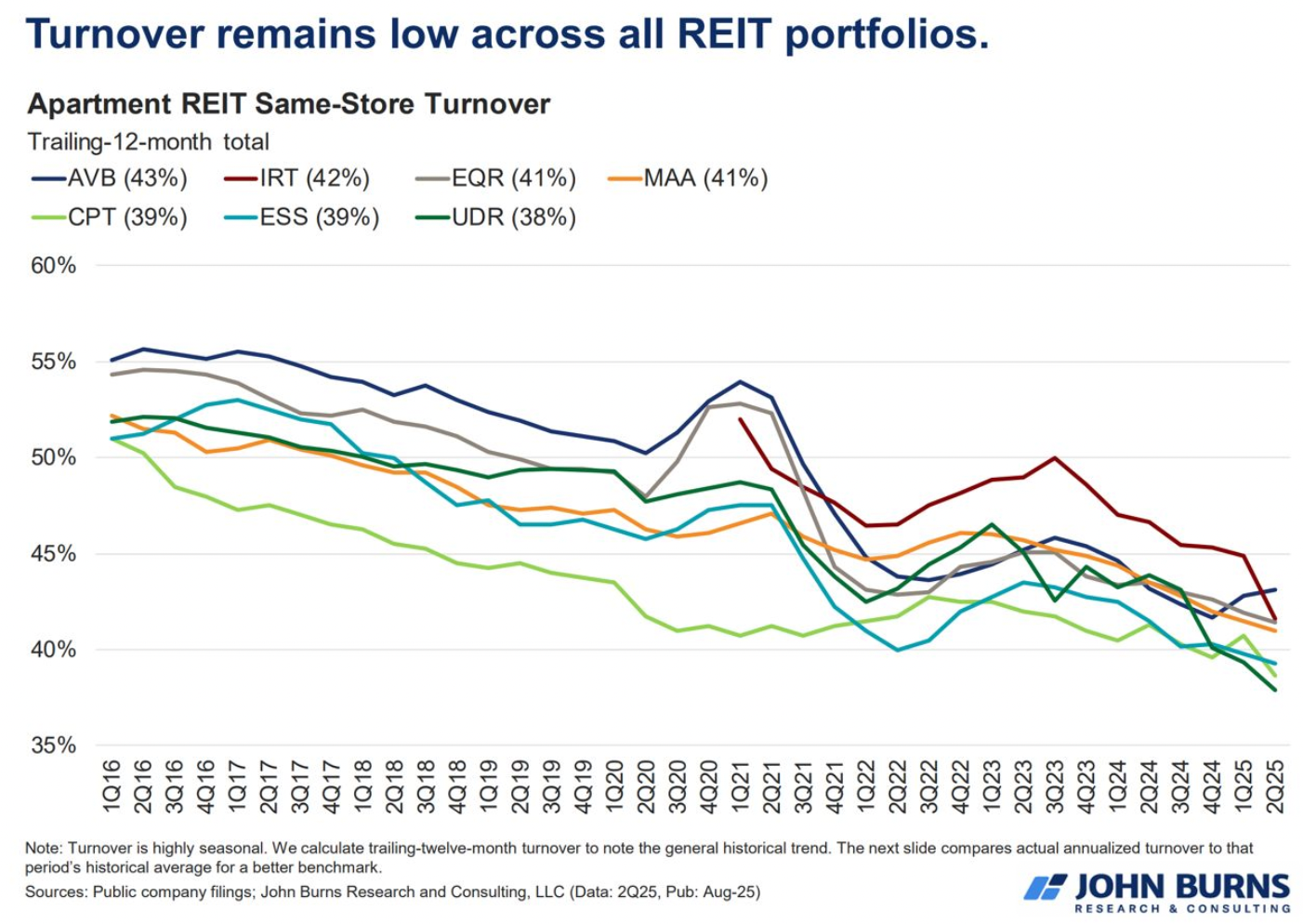

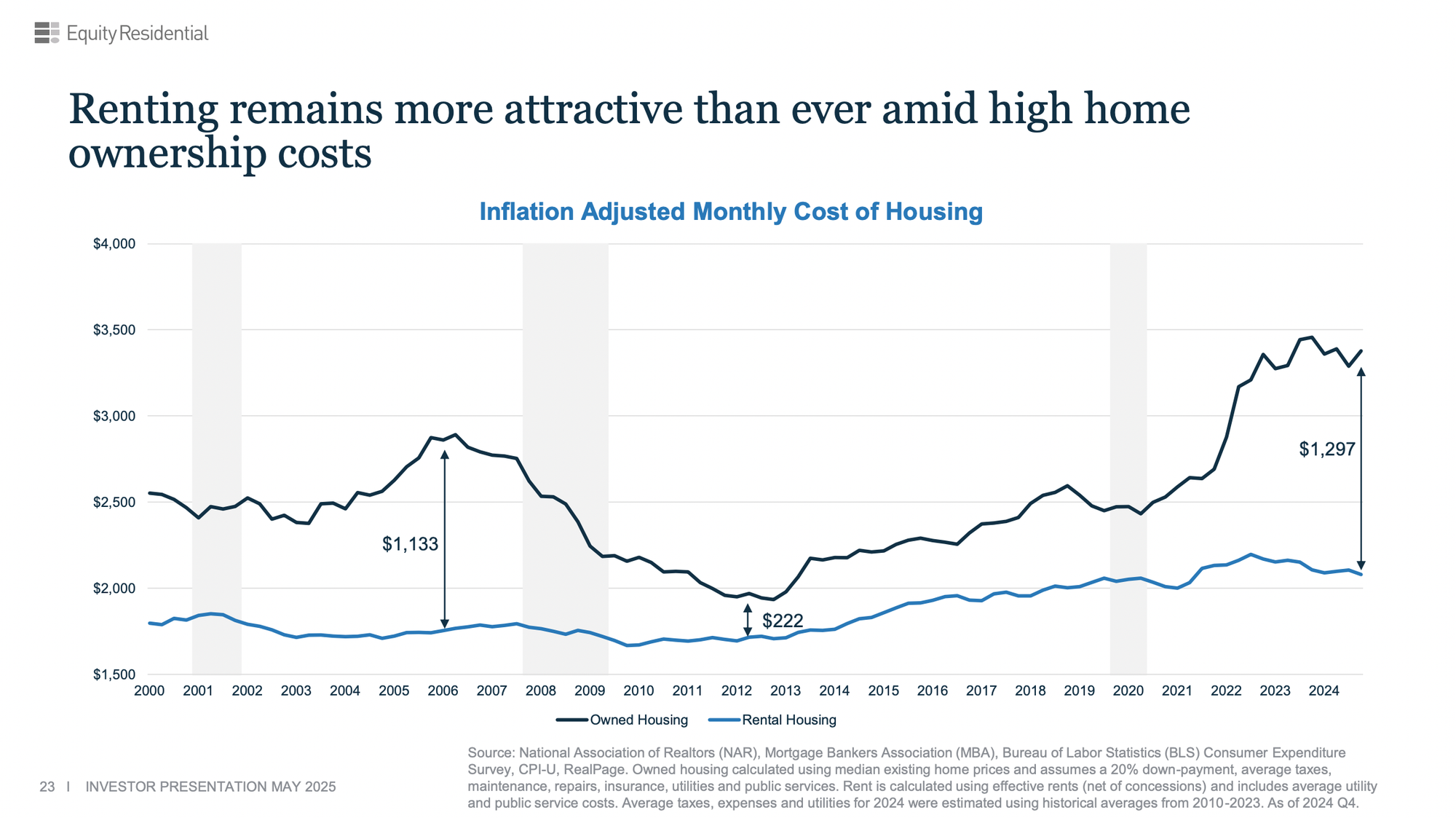

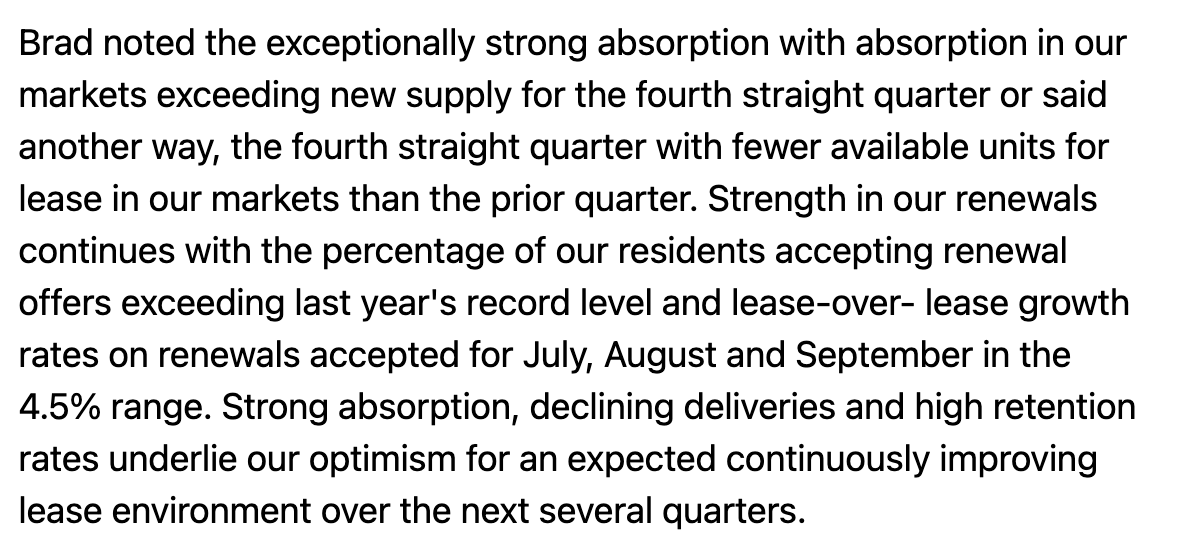

- Continued strength in renewals with resident retention continuing to hold at/near all-time highs. This despite the wall of supply which has plagued the sector over the past 2+ years). This is actually quite amazing - renters are seeing brand new buildings near by offering concessions (one month free!) and choosing to stay at their existing building despite a 4-5% rent increase. Part of the reason for this is the prohibitive cost of homeownership as shown below which has lead to more 'renters by necessity'.

- Favorable expense trends, notably in property taxes/insurance (which represent 40-50% of total opex.

- UDR/ESS/AVB/CPT raised and MAA/INVH maintained NOI guidance for FY25 with favorable opex offsetting/more than offsetting new lease softness.

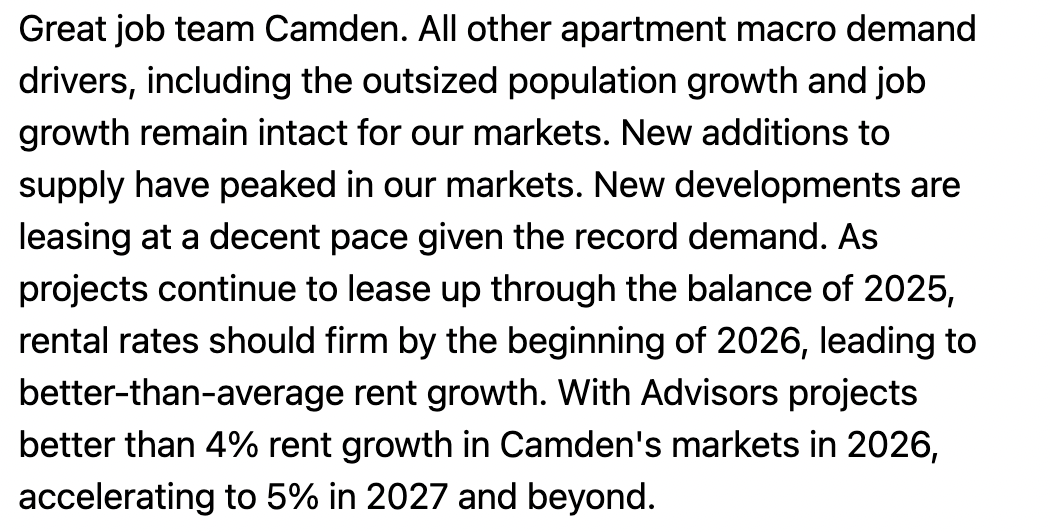

For long-term (3-5 year) investors here is the quite good:

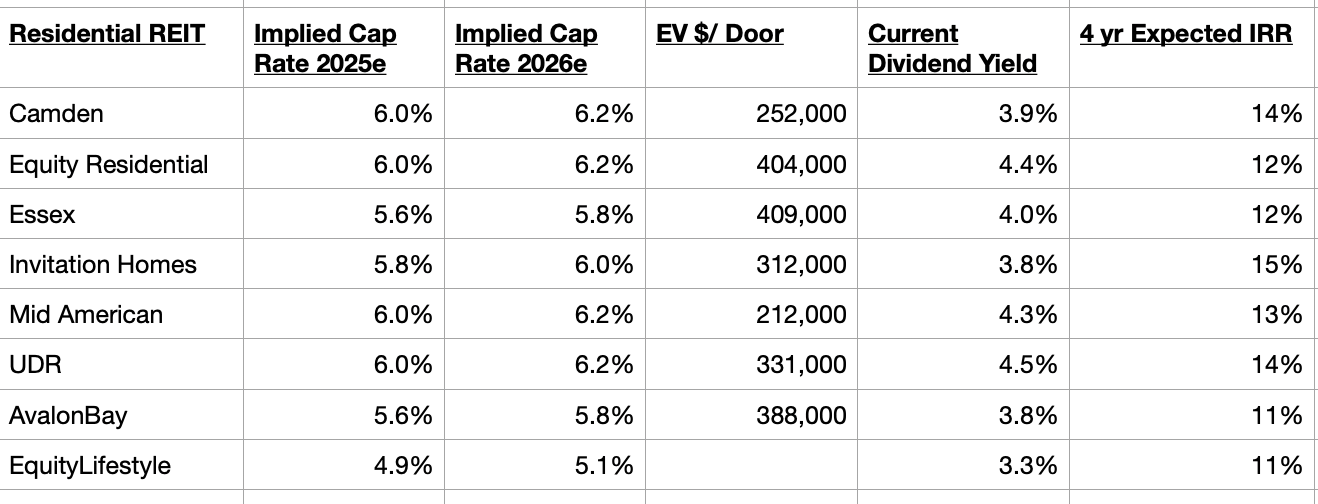

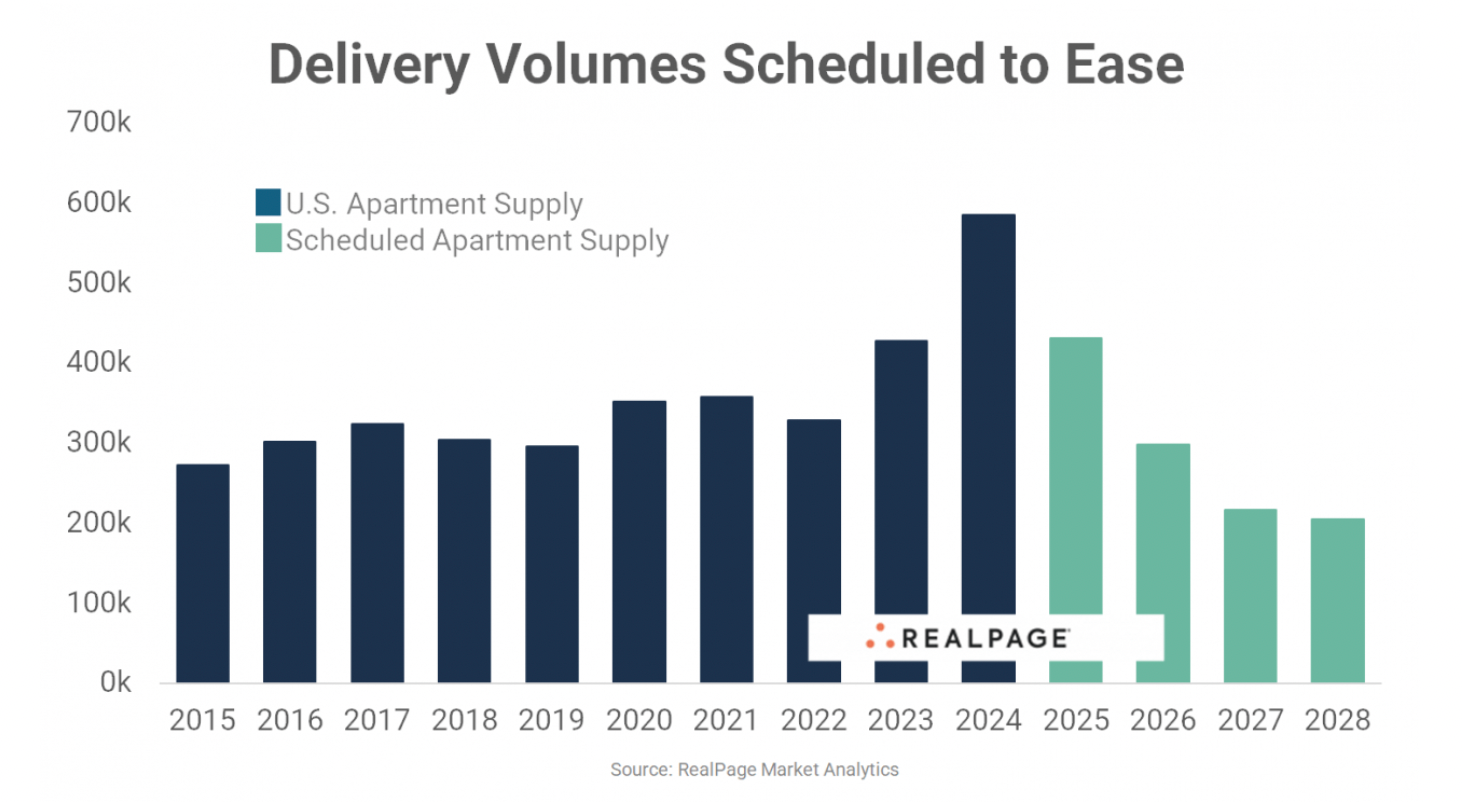

- Valuations (shown below) are very attractive following the selloff, particularly given the favorable set up for 2026-2029 (new deliveries set to fall off a cliff):

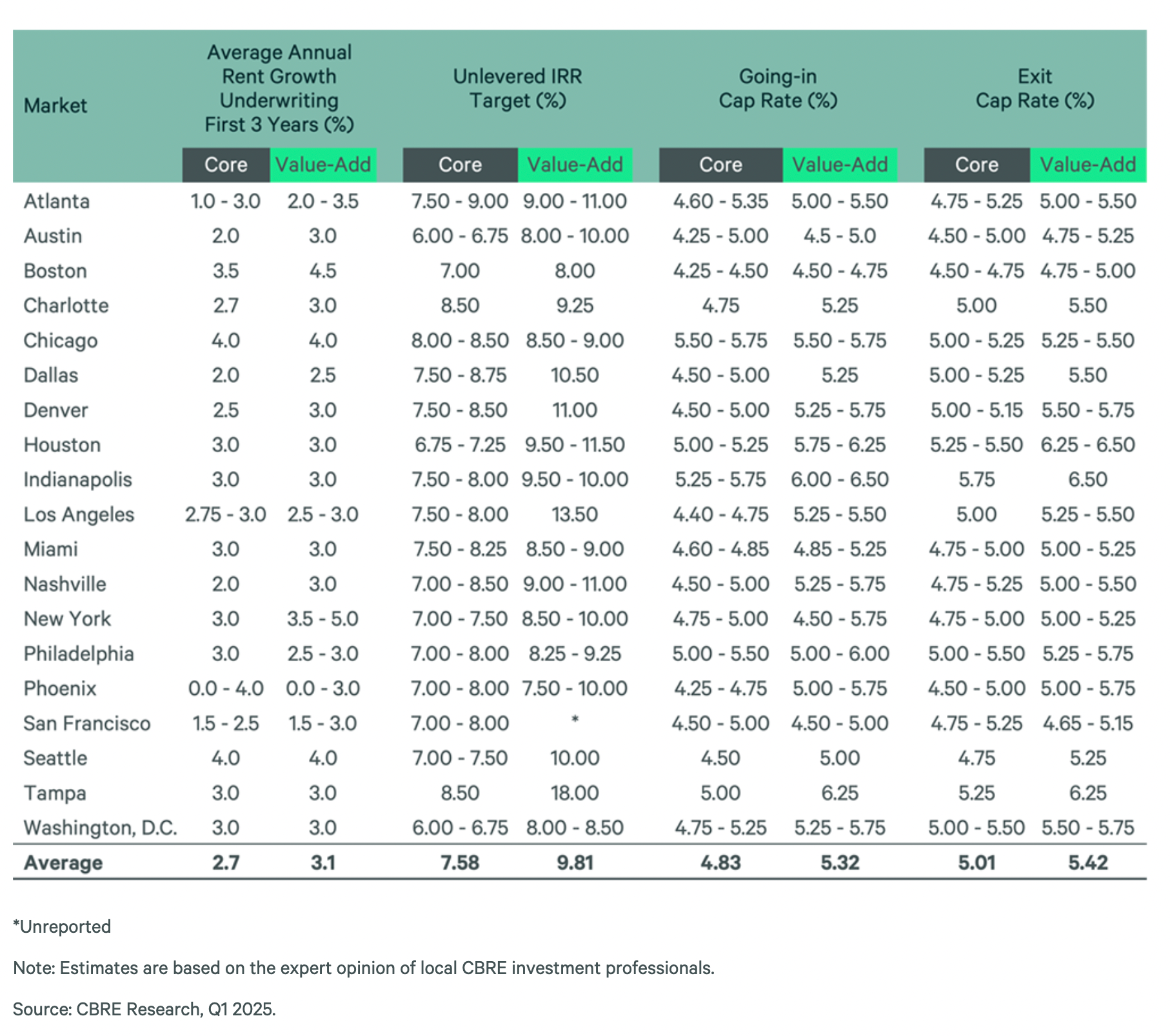

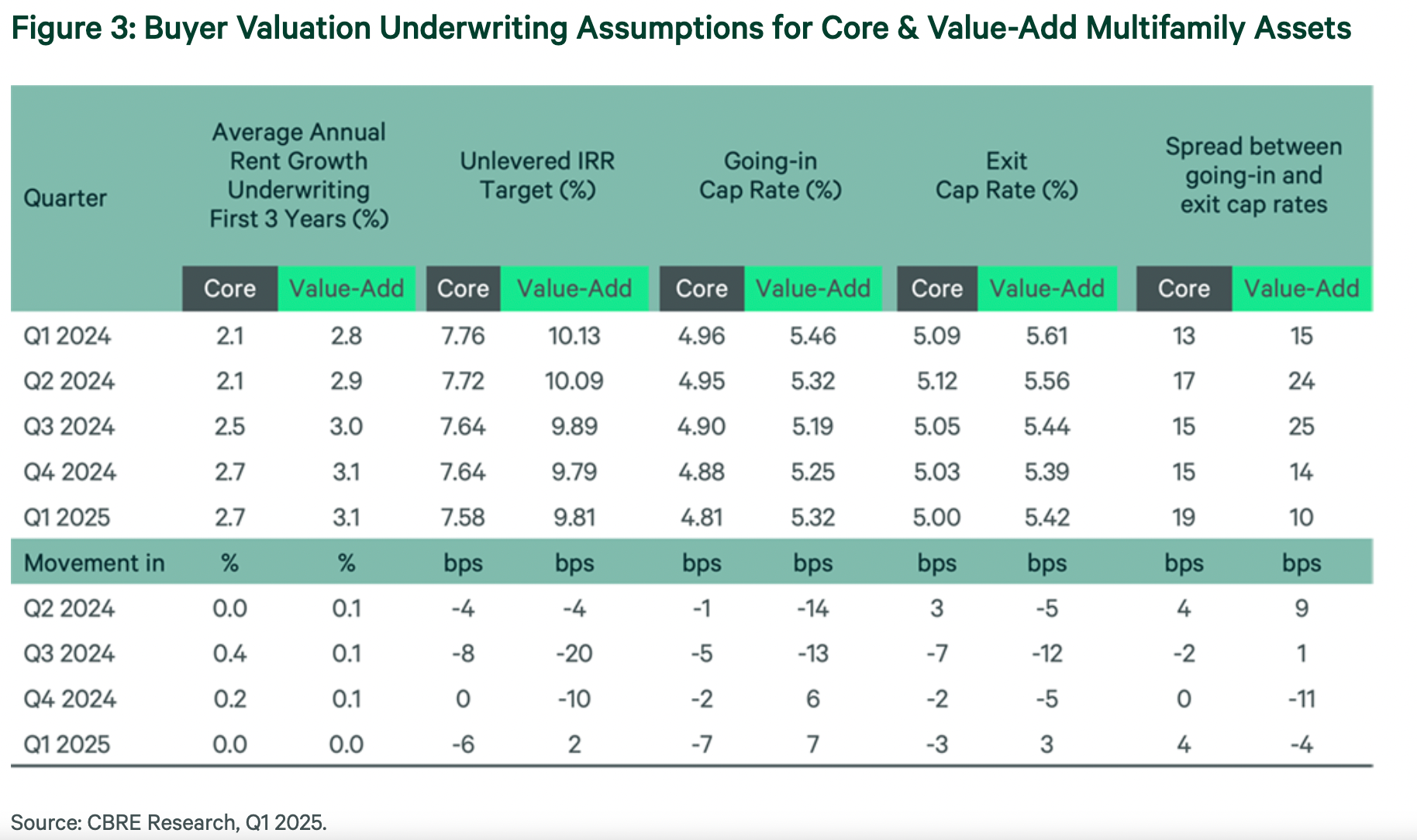

Valuation notes: NOI/EV proportionally consolidated. Property mgmt expenses deducted from NOI. 2025 cap rate based on current EV & guidance. IRRs assume 2026 modest NOI growth (2-3%) followed by a pickup in 2027-2030 (3-4%) on back of dramatic reduction in new deliveries. Assumed exit cap rates ~5.5% sunbelt, ~5% coastal (5% for all of INVH). Expected IRR is a function of going in cap rate, expected growth, terminal cap rate and leverage. Below I show the CBRE 1Q25 private market transaction cap rates - while private buyers are taking the imminent inflection in supply/rent growth into account and pricing core multifamily assets around a 5 cap, the public markets are not.

An imminent inflection in Supply / Rents heading into 2026:

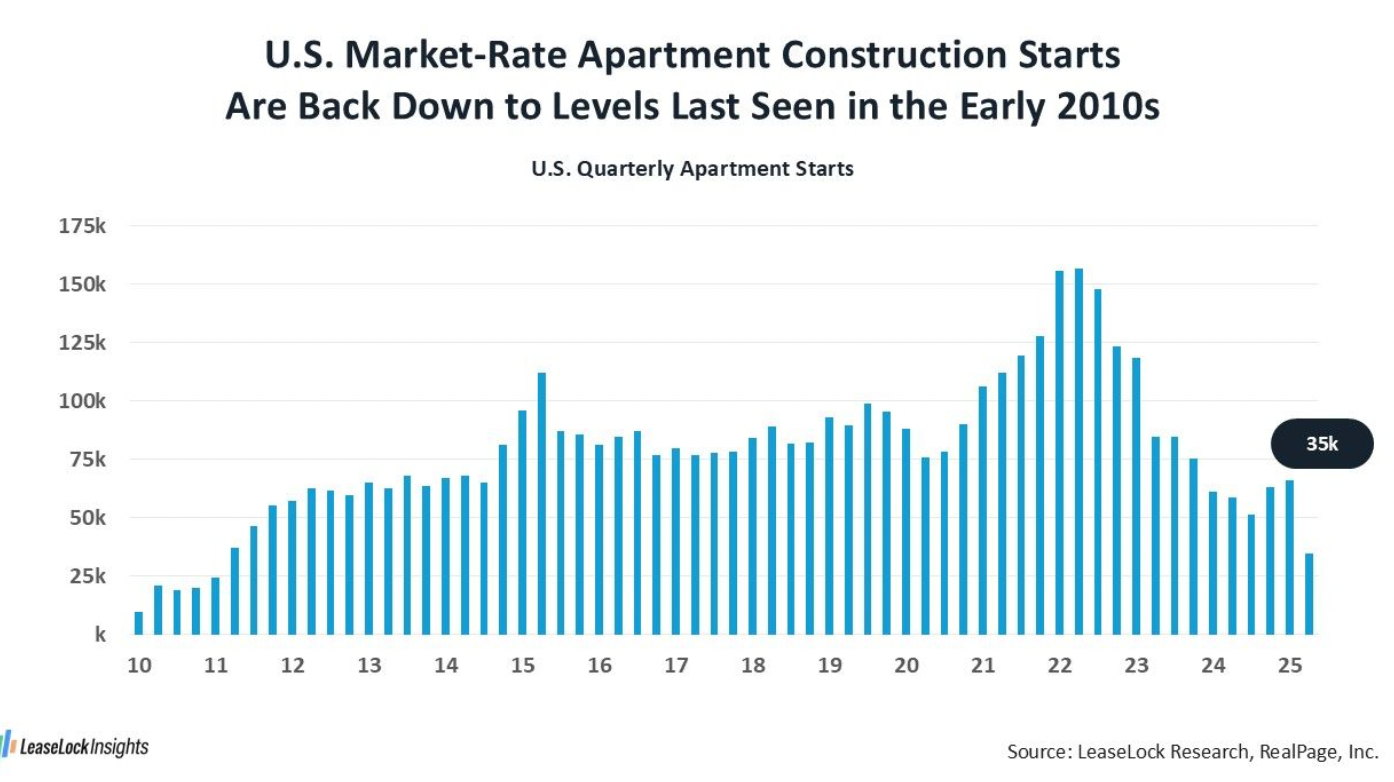

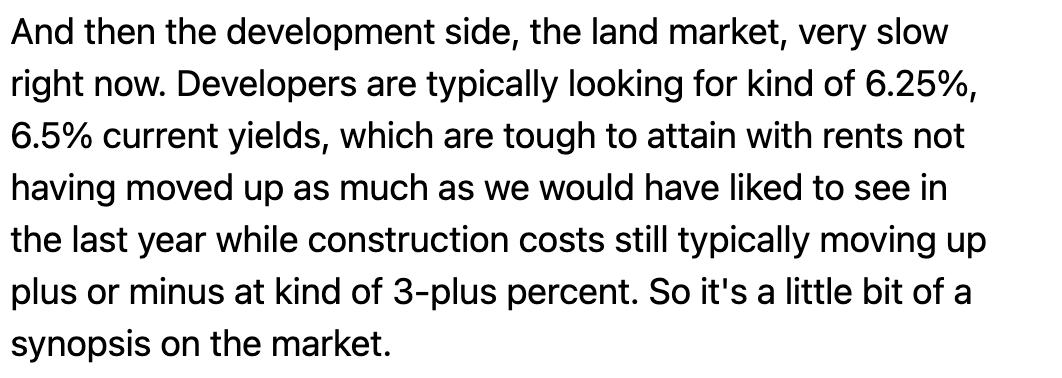

As go the assumptions used for in determining IRRs, I suspect the 3-4% NOI growth from 2027-2030 will prove conservative. As shown above, deliveries are set to fall off a cliff in 2026 and will likely remain low until 2029. Higher for longer interest rates coupled with challenged developer economics suggest that it could be awhile before we see a meaningful pickup in starts which could extend the period of above normal NOI growth.

Overall I see this selloff as a bump in the road - the deluge of supply which has hit the market over the past two years has caused a stalling of rent. But we are quite close to the end of this delivery cycle and will then be in what I expect to be a prolonged period of very favorable supply/demand fundamentals which will drive NOI growth higher for longer. Moreover balance sheets are very very strong and the REITs have demonstrated access to low cost capital (most have issued 5-10 year debt in the low 5s over the past year) giving REITs the firepower to grow through acquisition or development. I added to my positions across the board.

Here's a very recent update on the US multifamily space w/ Jay Parsons and CBRE's MattVance:

Disclosure: This report should not be read by anyone. This is NOT investment advice. Assume everything written/presented is wrong. Do your own work. Author owns securities of companies mentioned above.

Song:

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.